IRS 2220 2024-2025 free printable template

Show details

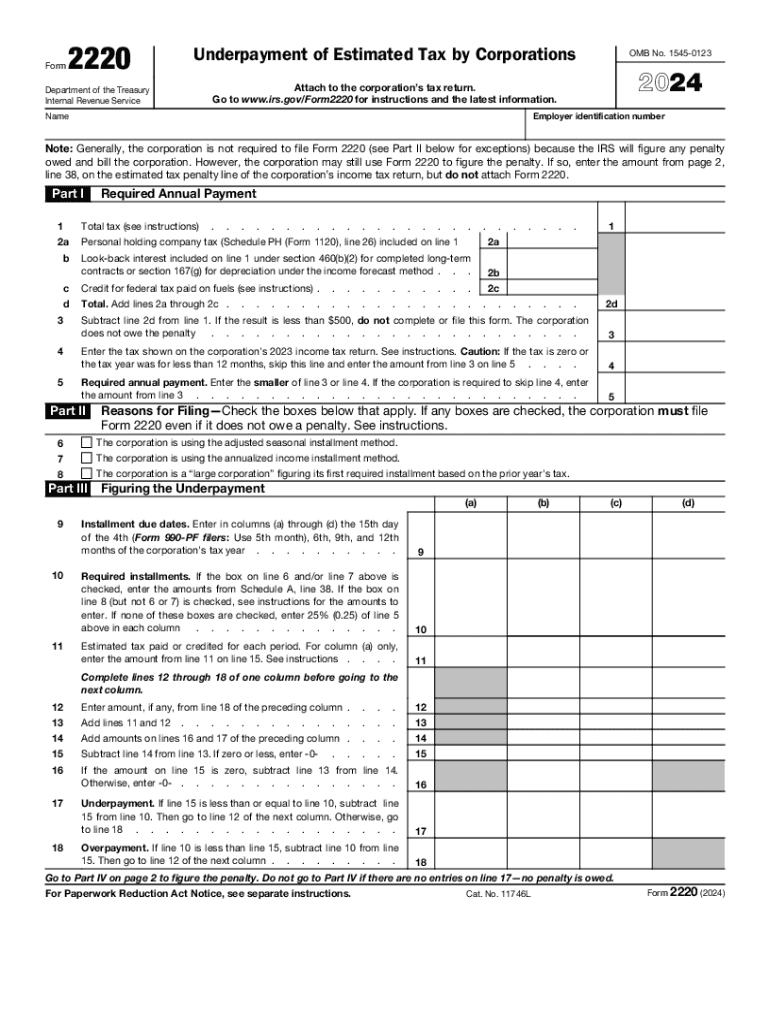

Subtract line 38 of the preceding column from line 37 of the preceding column. Add lines 35 and 36 and on page 1 of Form 2220 line 10. If so enter the amount from page 2 line 38 on the estimated tax penalty line of the corporation s income tax return but do not attach Form 2220. Cat. No. 11746L Form 2220 2024 Page 2 Figuring the Penalty Enter the date of payment or the 15th day of the 4th month after the close of the tax year whichever is earlier. See Enter any other taxes for each payment...

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 2220

Step-by-Step Instructions for Editing IRS Form 2220

Guidelines for Completing IRS Form 2220

Understanding and Utilizing IRS Form 2220

IRS Form 2220 is a crucial tool for taxpayers who need to calculate underpayment penalties related to estimated tax. It provides a systematic approach to ensuring compliance with federal tax obligations. By understanding this form, you can avoid unnecessary penalties and ensure your financial records remain in good standing.

Step-by-Step Instructions for Editing IRS Form 2220

To effectively manage your IRS Form 2220, follow these detailed steps:

01

Gather your financial documents, including prior year's tax returns, current income statements, and payment receipts to assess your estimated tax for the year.

02

Access the latest version of IRS Form 2220 from the official IRS website or through reliable tax preparation software.

03

Carefully enter your tax year and other identifying information as prompted on the form.

04

Calculate your required annual payment based on the IRS guidelines, inputting any payments already made.

05

Review your entries for accuracy before submitting the form or including it with your tax return.

Guidelines for Completing IRS Form 2220

Completing IRS Form 2220 necessitates understanding specific sections and requirements. Ensure to:

01

Input your total tax for the year, which should be derived from your latest tax return.

02

Determine the estimated payments you've made, including withholdings and any other relevant credits.

03

Follow the worksheet provided in the form to accurately calculate your payment shortfall, if applicable.

04

Seek assistance from a tax professional if you encounter complexities in your calculations.

Show more

Show less

Updates and Changes to IRS Form 2220

Updates and Changes to IRS Form 2220

Recent revisions to IRS Form 2220 have introduced notable changes that affect taxpayers. Be aware of:

01

Adjustments to the income thresholds for penalty calculations that may influence your estimated payments.

02

New provisions added for certain types of income, including passive incomes and capital gains, affecting how penalties are calculated.

03

Clarifications on the types of situations that qualify for exemptions from underpayment penalties, streamlining the filing process for eligible taxpayers.

Essential Insights on IRS Form 2220: Purpose and Applications

Defining IRS Form 2220

Understanding the Purpose of IRS Form 2220

Who Needs to Complete IRS Form 2220?

Conditions for Exemption from IRS Form 2220

Key Components of IRS Form 2220

Submission Deadline for IRS Form 2220

Comparing IRS Form 2220 with Similar Tax Forms

Applicable Transactions Covered by IRS Form 2220

Copies of IRS Form 2220 Required for Submission

Penalties Associated with Non-Submission of IRS Form 2220

Information Required When Filing IRS Form 2220

Other Forms Often Accompanying IRS Form 2220

Mailing Address for IRS Form 2220 Submission

Essential Insights on IRS Form 2220: Purpose and Applications

Defining IRS Form 2220

IRS Form 2220 is a form used primarily to determine if you owe a penalty for underpaying estimated tax. By using this form, taxpayers can calculate their total tax liability accurately and assess if they have made sufficient estimated tax payments throughout the year.

Understanding the Purpose of IRS Form 2220

The primary aim of IRS Form 2220 is to help taxpayers calculate their estimated tax underpayment penalties. It offers taxpayers a way to demonstrate compliance with federal tax laws and stipulates the conditions under which penalties are assessed.

Who Needs to Complete IRS Form 2220?

IRS Form 2220 should be completed by individuals who are likely to face underpayment penalties, particularly:

01

Self-employed individuals with variable income.

02

Taxpayers who have received significant unwithheld income, such as dividends or capital gains.

03

Corporations and partnerships that need to assess underpayment penalties for estimated tax liability.

Conditions for Exemption from IRS Form 2220

Certain taxpayers may qualify for exemptions from penalties assessed using Form 2220, including:

01

Taxpayers with an adjusted gross income below $1,000.

02

Those who had no tax liability in the previous year.

03

Individuals who made timely payments and meet specific criteria set out in IRS guidelines.

Key Components of IRS Form 2220

The form consists of several sections, each designed to capture essential taxpayer information and payment history:

01

Identification section, where taxpayers provide their details.

02

Calculation section for estimated payments, detailing tax owed versus paid.

03

Penalty calculation segment, which assesses if penalties are due based on underpayment amounts.

Submission Deadline for IRS Form 2220

The deadline for submitting IRS Form 2220 coincides with your annual tax filing date. Typically, this means you must file by April 15 for most individual taxpayers, though extensions may apply if filed appropriately.

Comparing IRS Form 2220 with Similar Tax Forms

IRS Form 2220 is distinct from other tax forms like:

01

IRS Form 1040: Used for filing individual income taxes without specific focus on underpayment penalties.

02

IRS Form 2210: Another form that may acknowledge underpayment penalties but differs in calculating certain types of estimates.

Applicable Transactions Covered by IRS Form 2220

This form primarily covers transactions that lead to underpayment penalties, including but not limited to:

01

Self-employment income.

02

Investment income not subjected to withholding.

03

Rent or royalty income exceeding a certain threshold.

Copies of IRS Form 2220 Required for Submission

Typically, only one copy of IRS Form 2220 is necessary for submission with your tax return. However, consider retaining an additional copy for your personal records.

Penalties Associated with Non-Submission of IRS Form 2220

Failure to submit IRS Form 2220 can result in various penalties, including:

01

Financial Penalty: A percentage of the owed tax can accumulate as interest and late fees.

02

Legal Repercussions: Non-compliance may lead to a more extensive IRS audit or additional scrutiny of your financial records.

Information Required When Filing IRS Form 2220

When filing IRS Form 2220, ensure you have the following information ready:

01

Your Social Security Number or Employer Identification Number (EIN).

02

Details of estimated payments made during the tax year.

03

Last year’s tax return for reference.

Other Forms Often Accompanying IRS Form 2220

In scenarios where extra documentation is necessary, consider including:

01

IRS Form 1040 for individual taxpayers.

02

IRS Form 2210 if further penalty details or considerations are warranted.

Mailing Address for IRS Form 2220 Submission

IRS Form 2220 should be submitted to the appropriate IRS address corresponding to your location and the type of return filed. Refer to the IRS instructions on the form for the most accurate submission address, ensuring your form reaches the correct department swiftly.

By mastering the nuances of IRS Form 2220, you can safeguard your financial well-being and ensure compliance with tax obligations. For further assistance or to start using tax preparation tools, consider reaching out to a tax professional or exploring software solutions designed to simplify the filing process.

Show more

Show less

Try Risk Free