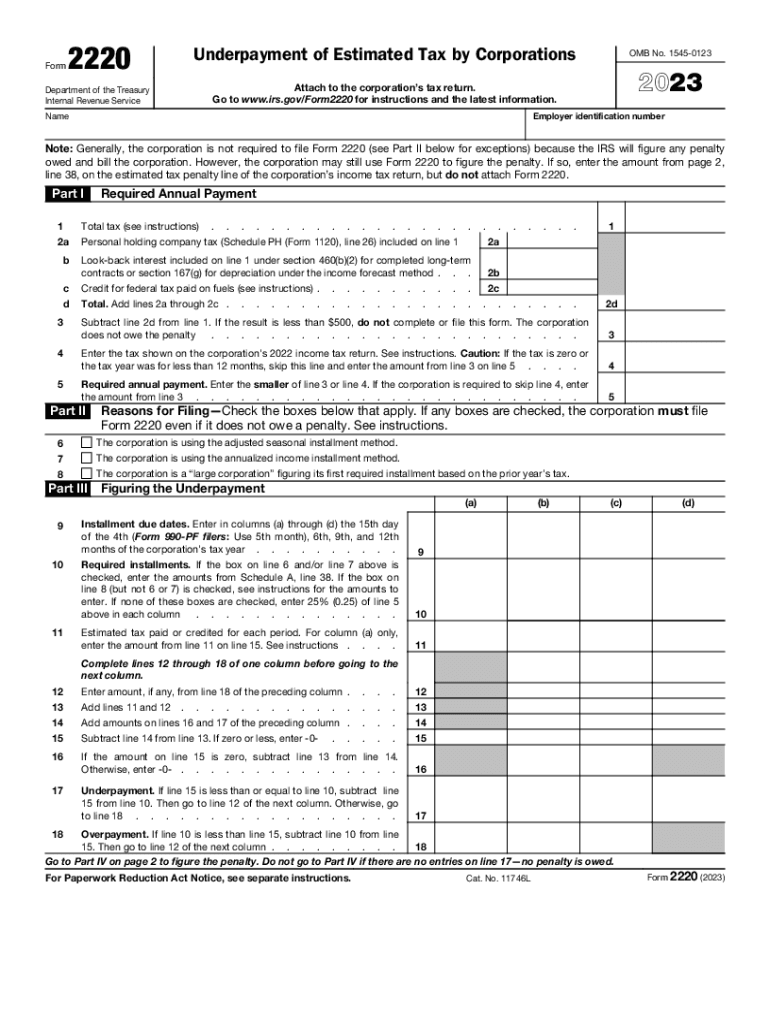

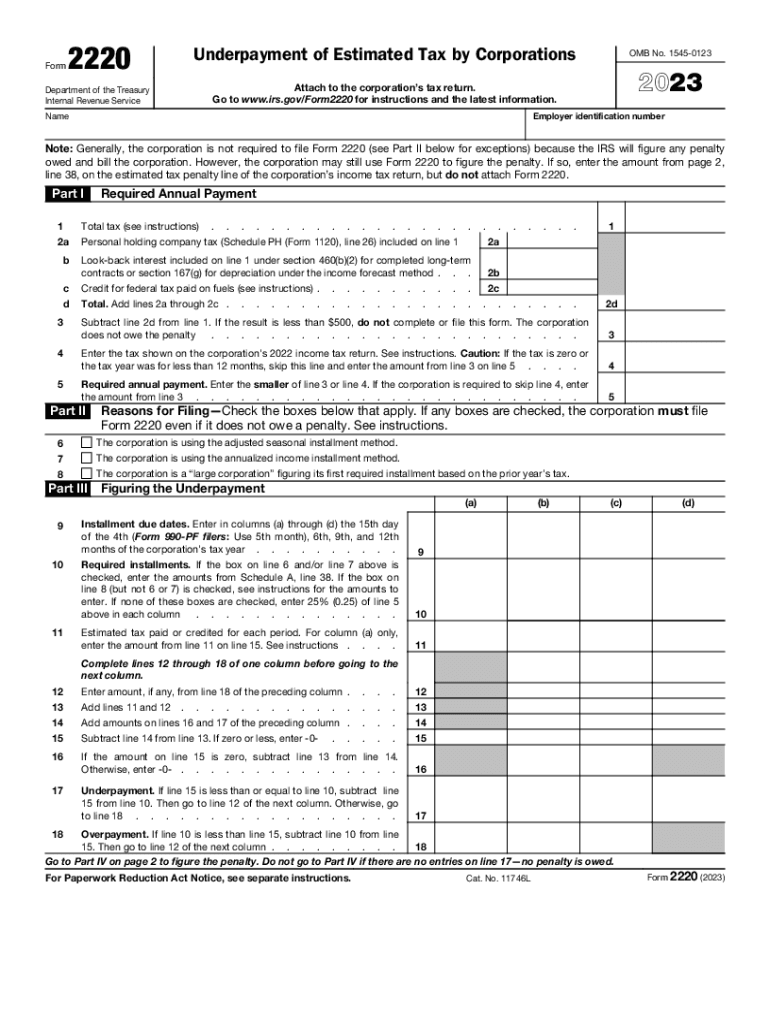

IRS 2220 2023-2024 free printable template

Get, Create, Make and Sign

Editing irs form 2210 online

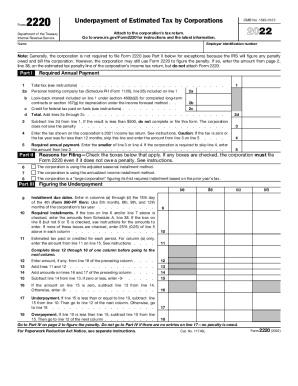

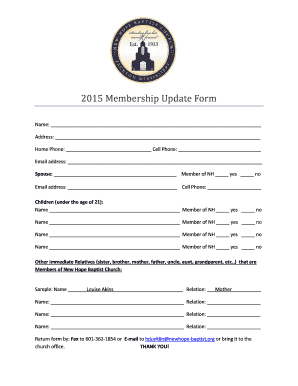

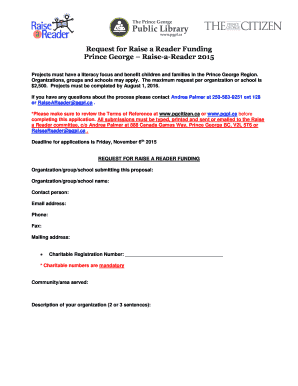

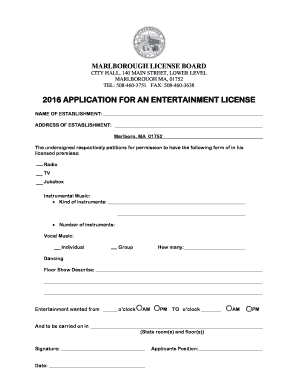

IRS 2220 Form Versions

How to fill out irs form 2210 2023-2024

How to fill out form 2220 underpayment of

Who needs form 2220 underpayment of?

Video instructions and help with filling out and completing irs form 2210

Instructions and Help about irs form 2210 for 2023

How to fill out the 2021 IRS form 1040 the 1044 may look complex however don't be overwhelmed with doing taxes and filling out the form here we will step through some of the more common lines for the 1040 to help give you an idea of what things you likely will need to fill out first what is form 1040 form 1040 is the U.S. individual income tax return it is a federal income tax form that people use to report their income to the IRS and claim tax deductions or credits it is used to calculate their tax refund and tax bill for the year you may file your tax return online with tax software, or you can also download form 1040 directly from the IRS website if you prefer to complete your return by hand what is on the 1040 tax form before we get into the details of the 1040 let's take a quick overview of what we will be looking at first it asks you who you are the top of form 1040 collects basic information such as your name address social security number your tax filing status and how many tax dependents you have...

Fill 2220 instructions : Try Risk Free

People Also Ask about irs form 2210

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your irs form 2210 2023-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.